Welcome to Donore Credit Union , Ireland’s oldest credit union. The story of Donore Credit Union Limited (DCUL) can be traced back to April 1958 when a meeting of Cumann Muintir Dun Oir ( Donore Parishioner’s Union ) was held in St Joseph’s Hall on Cork Street with the inaugural meeting of the Credit Union taking place on April 26th 1958 at 35 Hamilton Street.

The previous year, two sisters Eileen and Angela Byrne had attended the National Co-operative Council meeting from where they brought the idea back to Donore Avenue. In the beginning the Credit Union operated from St Joseph’s Hall before it rented premises on Ebenezer Street in 1969. In 1991, the Credit Union moved into a purpose built premises on Rutledge Terrace from where it still operates. While the Credit Union had assets of £100 and a membership of 100 in its first year, it quickly grew to where it is today, having assets of €40 million and a membership of just over 5,500.

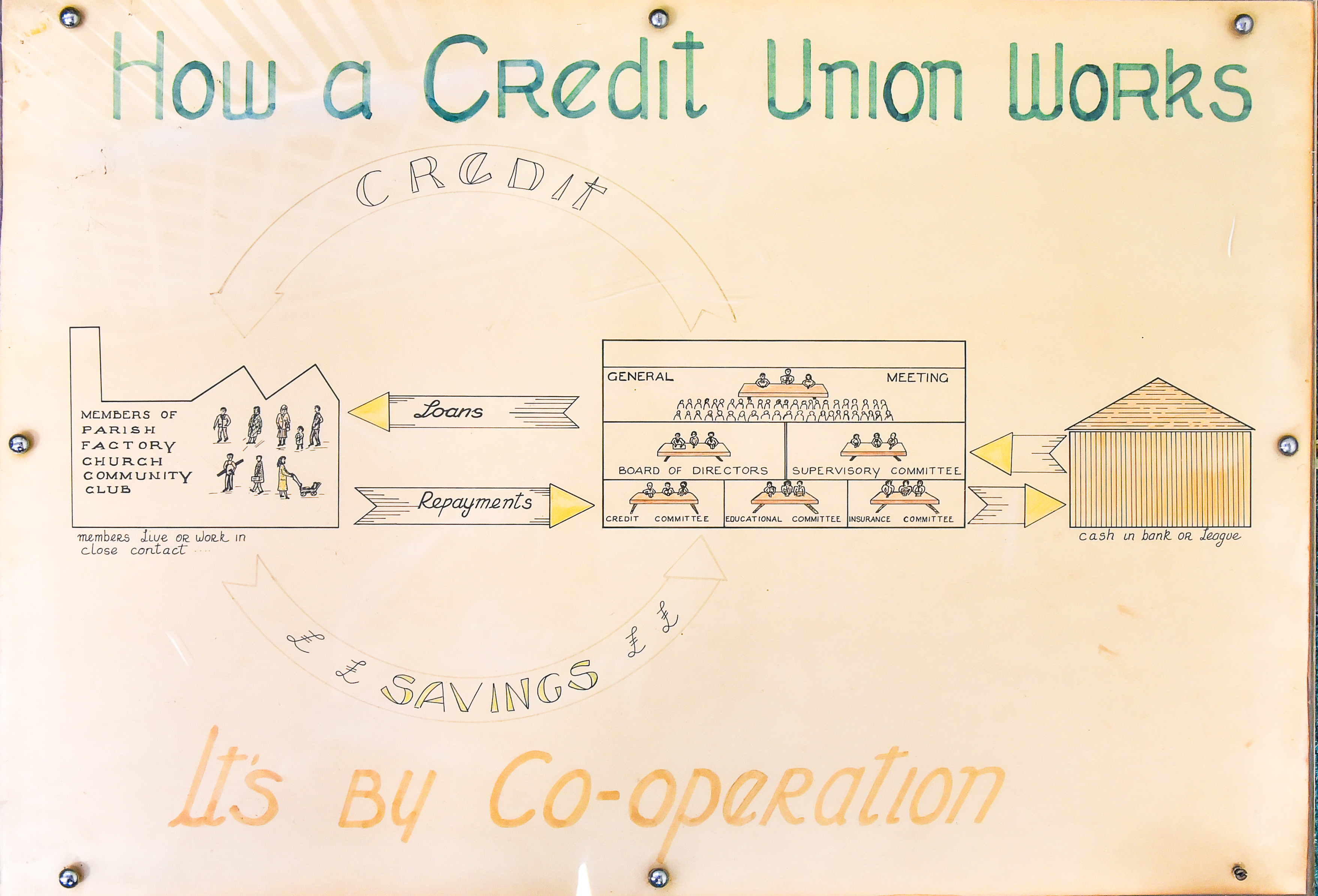

DCUL continues to focus on the core business of loans and savings. The Board is mindful of the credit union’s iconic status as the oldest credit union in the country and wishes to leverage this position with all of its stake-holders including its members and the regulatory authorities.

The Board of DCUL is committed to operating in accordance with the credit union principles and to dealing with members in a professional and respectful manner at all times.

The Board of Directors has the power to delegate certain functions to committees and / officers. Certain committees and officers are required by law and are therefore referred to as ‘statutory committees and officers’ (e.g. Credit Committee, Credit Control Committee, Membership Committee and Nominations Committee). While the composition and role of statutory committees is defined in legislation, each committee and office-holder will have a term of reference.

DCUL has established several non-statutory committees to oversee certain operational activities. Participation on committees is open to non-Board members and is a useful training ground for potential directors. The credit union will constitute the following committees and officers as indicated below. With a nine (9) person board and eight (8) committees, it is anticipated that each director will have an opportunity to chair at least one committee, which will spread the work load as well as controlling any negative consequence of board dominance by any one individual director, which is often touted as an inherent flaw in voluntary boards.

Committees

- Credit Committee

- Credit Control Committee

- Membership Committee

- Nomination Committee

- Education, Promotion and Sponsorship Committee

- Investment Committee

- Strategic Review Committee

- Audit, Compliance and Risk Committee

Officers

- Chairman (B)

- Vice-chairman (B)

- Secretary (B)

- Complaints Officer (B)

- Credit Officers (S)

- Credit Control Officer (S)

- Insurance Officer (S)

- Money Laundering Reporting Officer (B)

- Anti-Money Laundering Officer

- Health & Safety Officer (S)

- Data Controller (S)

- Training Liaison Officer (S)

- Compliance Officer (S)

- Risk Management Officer (S)

S=Staff Member

B-Board

Working Groups

- Health and Safety

- IT

- Mergers

In addition the Board has established a Health and Safety Working Group composed of staff and a Working Group on IT and Mergers , the latter two of which are sub- committees of the Strategic Review Committee.

Internal Audit

The Board has re-appointed FMB as Internal Auditor wef 01 Oct 2015.

Investment Advisor

The Board has appointed Merrion Capital as Investment Advisor wef 01 Oct 2015

The Credit Union Story

The modern credit union movement can trace its origins to Germany and to Friedrich Willhelm Raiffeisen, the Mayor of a small town in southern Germany, who in 1849 formed societies, which later evolved into Credit Unions. The purpose of these Credit Unions was to enable people to help themselves in relieving debt and poverty. A credit union is a democratic, financial co-operative owned and controlled by its own members with each credit union is run for the benefit of its members, all of whom have something in common - the Common Bond.

The credit union movement was first introduced into Ireland in 1958 by Nora Herlilhy with the support of a number of other dedicated pioneers. Since then, the credit union philosophy of mutual self-help has proved very popular and there are now over 450 credit unions affiliated to the Irish league of Credit Unions throughout the island of Ireland. In Ireland over three million members have recognized the value of credit unions and have savings approaching several billion euro with their credit unions. There are hundreds employed in the sector and many thousands have volunteered their services in the movement.

The Credit Union Mission

The mission of every credit union is to promote the financial well being of its members. In order to achieve this goal , credit unions are committed to providing a broad range of financial services supported by excellent member care from dedicated and well-trained staff. These services are administered in accordance with sound management practices in order to maintain the financial strength of the credit union. Credit Unions in the Republic of Ireland are regulated entities and are regulated by the Registrar of Credit Unions , which is part of the Central Bank of Ireland.

We offer many services aimed at improving access to financial services and encouraging financial inclusion.

Enjoy all the benefits of a modern, digital financial services provider, with the added advantage of being local.